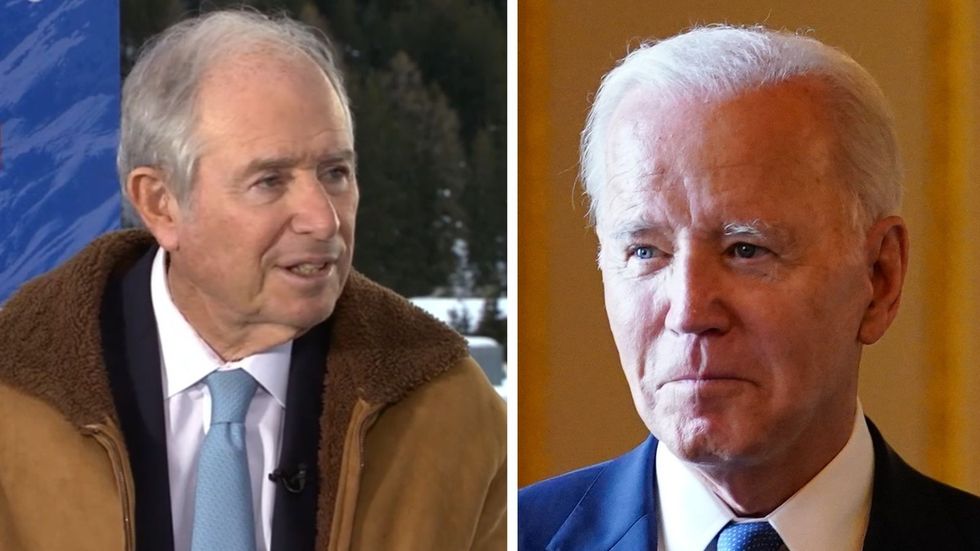

The boss of Blackstone, the world’s largest alternative asset manager, has expressed his doubts about the US economy if President Joe Biden wins the US re-election this year.

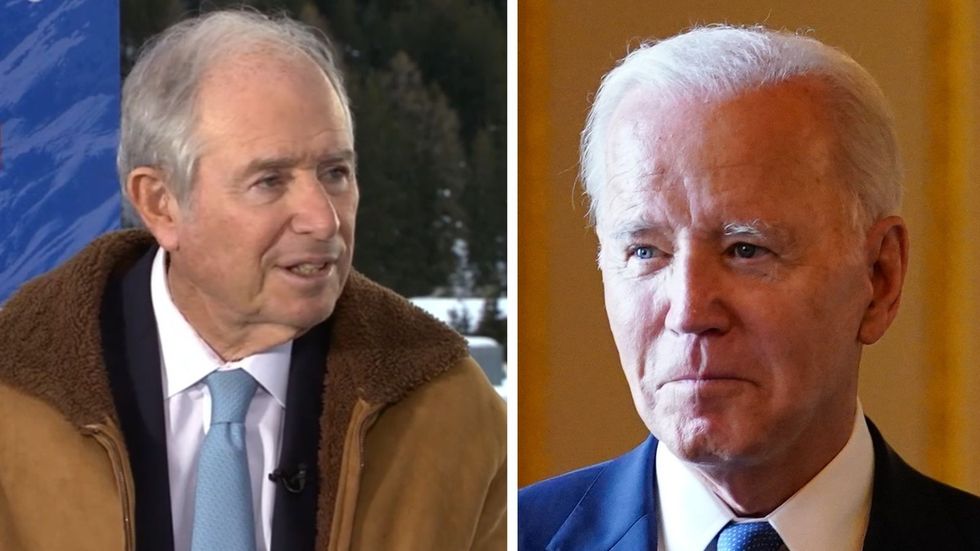

Stephen Schwarzman made the remarks after he was asked what he thought would happen to the economy if Biden was elected for a second term.

Speaking to Bloomberg, he said: “We’ve now got $2trillion deficits with no end in sight.

“We’ve got our debt-to-GDP [ratio] going up. We’ve got open borders with eight million people coming over.

“I don’t know that the country, frankly, is prepared for four more years of that.”

The US national debt hit $34.1trillion by January 31, according to the real-time US debt clock.

This is more than the combined GDP of the top five global economies after the US - China ($17.9trillion), Japan ($4.2trillion), Germany ($4.0trillion), India ($3.4trillion) and the UK ($3.0trillion), World Bank data shows.

On the same day, the US federal budget deficit was at $1.75trillion.

Nevertheless, Mr Schwarzman said he was "optimistic" for 2024.

Pointing out the economy is slowing "a bit", he said: "That's normal with high interest rates."

However, Mr Schwarzman said he was sure the Federal Reserve would cut interest rates, expecting them to be reduced in the second half of the year.

He added: "I think 2024 will be a good year. I think it'll start out slower, in the sense that interest rates are still pretty high and the Fed will keep them that way... probably until the second half [of the year]."

LATEST DEVELOPMENTS:

- Recession alert as UK economy risks ‘prolonged downturn if rates not cut'

- Bank of England ‘should have cut interest rates today but they acted too late again’

- Energy bill hikes push 2.2 million into fuel poverty

The Federal Reserve held the target rate at 5.25 to 5.5 per cent on Wednesday.

"We will get the cuts," Mr Schwarzman insisted, explaining the way Blackstone measures inflation means they are finding it's already at the Fed target of two per cent.

"I think it's quite confident that they'll be lowering rates."

from GB News https://ift.tt/nuN3RKE

0 Comments